Multiple Choice

Use the following information to answer the following questions.

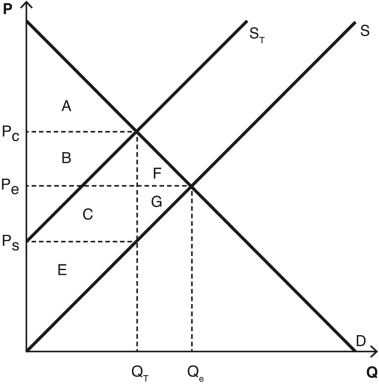

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-What is the total amount of producer and consumer surplus (i.e. ,social welfare) in this market after the tax is imposed?

A) A + B + C + E + F + G

B) A + E

C) A + B + C + E

D) F + G

E) B + C + F + G

Correct Answer:

Verified

Correct Answer:

Verified

Q86: For a given good,a seller's willingness to

Q87: When looking at a graph,the area under

Q88: Excise taxes are taxes that are<br>A) applied

Q89: Use the following graph to answer the

Q90: A tax that is applied to one

Q92: Another name for a consumer's willingness to

Q93: The elasticities of supply and demand are

Q94: Draw a set of supply and demand

Q95: All taxes create some deadweight loss,unless<br>A) the

Q96: When the price of a good increases