Essay

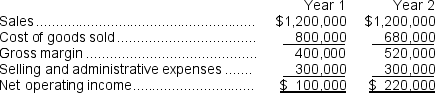

Miller Corporation produces a single product.The company had the following results for its first two years of operation:  In Year 1, the company produced and sold 40,000 units of its only product; in Year 2, the company again sold 40,000 units, but increased production to 50,000 units.The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year.Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e., a new fixed manufacturing overhead rate is computed each year).Variable selling and administrative expenses are $2 per unit sold.

In Year 1, the company produced and sold 40,000 units of its only product; in Year 2, the company again sold 40,000 units, but increased production to 50,000 units.The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year.Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e., a new fixed manufacturing overhead rate is computed each year).Variable selling and administrative expenses are $2 per unit sold.

Required:

a.Compute the unit product cost for each year under absorption costing and under variable costing.

b.Prepare a contribution format income statement for each year using variable costing.

c.Reconcile the variable costing and absorption costing income figures for each year.

d.Explain why the net operating income for Year 2 under absorption costing was higher than the net operating income for Year 1, although the same number of units were sold in each year.

Correct Answer:

Verified

a.Cost per unit under absorption costing...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: Common fixed expenses should not be allocated

Q104: Data for January for Bondi Corporation and

Q154: Elbrege Corporation manufactures a single product. The

Q192: Cahalane Corporation has provided the following data

Q252: Neef Corporation has provided the following data

Q283: Kneeland Corporation has two divisions: Grocery Division

Q285: Mccrone Corporation has provided the following data

Q287: When computing the break even for a

Q287: Simila Corporation has provided the following data

Q288: Carlton Corporation has two divisions: Delta and