Essay

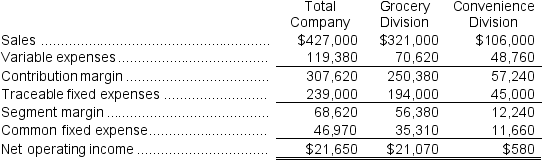

Kneeland Corporation has two divisions: Grocery Division and Convenience Division.The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.

The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a.What is the Grocery Division's break-even in sales dollars?

b.What is the Convenience Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

d.What would be the company's overall net operating income if the company operated at its two division's break-even points?

Correct Answer:

Verified

a.Grocery Division break-even:

Segment C...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Segment C...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: Common fixed expenses should not be allocated

Q82: Hadley Corporation, which has only one product,

Q192: Cahalane Corporation has provided the following data

Q278: Badoni Corporation has provided the following data

Q280: Omstadt Corporation produces and sells only two

Q285: Mccrone Corporation has provided the following data

Q286: Miller Corporation produces a single product.The company

Q287: When computing the break even for a

Q287: Simila Corporation has provided the following data

Q288: Carlton Corporation has two divisions: Delta and