Essay

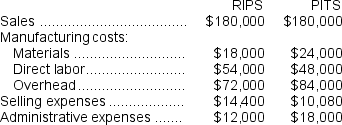

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS.Production is "for order" only, and no finished goods inventories are maintained; work in process inventories are negligible.The following data relate to last month's operations:  $36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement, in total and for the two products.Use the contribution approach.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: When unit sales are constant, but the

Q54: Common fixed expenses should not be allocated

Q82: Hadley Corporation, which has only one product,

Q192: Cahalane Corporation has provided the following data

Q227: J Corporation has two divisions. Division A

Q278: Badoni Corporation has provided the following data

Q283: Kneeland Corporation has two divisions: Grocery Division

Q285: Mccrone Corporation has provided the following data

Q287: When computing the break even for a

Q329: A company has two divisions, each selling