Multiple Choice

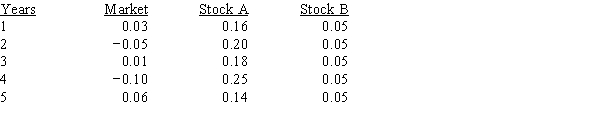

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and B.Which of the possible answers best describes the historical betas for A and B?

A) bA > 0; bB = 1.

B) bA > +1; bB = 0.

C) bA = 0; bB = −1.

D) bA < 0; bB = 0.

E) bA < −1; bB = 1.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: If you plotted the returns on a

Q43: A mutual fund manager has a $40

Q46: Assume that you manage a $10.00 million

Q47: Managers should under no conditions take actions

Q48: Consider the following information and then calculate

Q49: Returns for the Dayton Company over the

Q54: Which of the following statements is CORRECT?<br>A)

Q67: Nile Food's stock has a beta of

Q80: An individual stock's diversifiable risk, which is

Q102: Stock X has a beta of 0.6,while