Multiple Choice

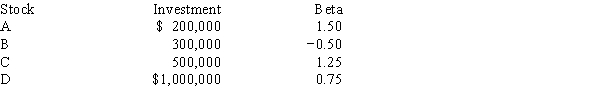

Consider the following information and then calculate the required rate of return for the Global Investment Fund,which holds 4 stocks.The market's required rate of return is 13.25%,the risk-free rate is 7.00%,and the Fund's assets are as follows:

A) 9.58%

B) 10.09%

C) 10.62%

D) 11.18%

E) 11.77%

Correct Answer:

Verified

Correct Answer:

Verified

Q11: If you plotted the returns on a

Q17: Any change in its beta is likely

Q43: A mutual fund manager has a $40

Q44: You have the following data on (1)the

Q46: Assume that you manage a $10.00 million

Q49: Returns for the Dayton Company over the

Q50: Tom Noel holds the following portfolio:<br><br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1783/.jpg"

Q52: Bae Inc.is considering an investment that has

Q80: An individual stock's diversifiable risk, which is

Q115: According to the Capital Asset Pricing Model,