Multiple Choice

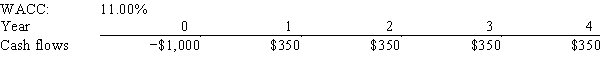

Tuttle Enterprises is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that if a project's projected NPV is negative,it should be rejected.

A) $77.49

B) $81.56

C) $85.86

D) $90.15

E) $94.66

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q39: Projects S and L are equally risky,mutually

Q45: A basic rule in capital budgeting is

Q56: Hindelang Inc.is considering a project that has

Q59: Suppose a firm relies exclusively on the

Q61: Nast Inc.is considering Projects S and L,whose

Q78: If the IRR of normal Project X

Q83: Which of the following statements is CORRECT?

Q94: Which of the following statements is CORRECT?

Q104: Assume a project has normal cash flows.All

Q107: A firm should never accept a project