Multiple Choice

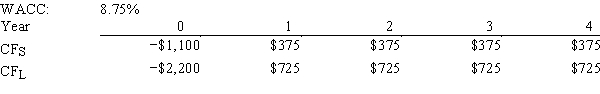

Nast Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV,how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

A) $32.12

B) $35.33

C) $38.87

D) $40.15

E) $42.16

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Projects S and L are equally risky,mutually

Q45: A basic rule in capital budgeting is

Q56: Hindelang Inc.is considering a project that has

Q60: Tuttle Enterprises is considering a project that

Q78: If the IRR of normal Project X

Q83: Which of the following statements is CORRECT?

Q94: Which of the following statements is CORRECT?

Q100: Other things held constant, an increase in

Q104: Assume a project has normal cash flows.All

Q107: A firm should never accept a project