Multiple Choice

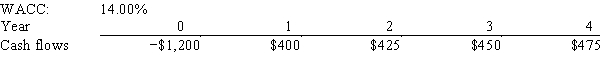

Jazz World Inc.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's projected NPV can be negative,in which case it will be rejected.

A) $41.25

B) $45.84

C) $50.93

D) $56.59

E) $62.88

Correct Answer:

Verified

Correct Answer:

Verified

Q4: In theory, capital budgeting decisions should depend

Q10: When evaluating mutually exclusive projects, the modified

Q27: Which of the following statements is CORRECT?<br>A)

Q27: When considering two mutually exclusive projects, the

Q33: Which of the following statements is CORRECT?<br>A)

Q42: Assuming that their NPVs based on the

Q47: The IRR of normal Project X is

Q60: McCall Manufacturing has a WACC of 10%.The

Q76: Yonan Inc.is considering Projects S and L,whose

Q91: Assume that the economy is in a