Multiple Choice

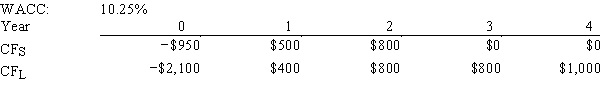

Yonan Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the shorter payback,some value may be forgone.How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost.

A) $24.14

B) $26.82

C) $29.80

D) $33.11

E) $36.42

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Which of the following statements is CORRECT?<br>A)

Q42: Which of the following statements is CORRECT?

Q42: Assuming that their NPVs based on the

Q47: The IRR of normal Project X is

Q58: Which of the following statements is CORRECT?<br>A)

Q73: Ingram Electric Products is considering a project

Q74: Taggart Inc.is considering a project that has

Q75: You are on the staff of Camden

Q81: Jazz World Inc.is considering a project that

Q91: Assume that the economy is in a