Multiple Choice

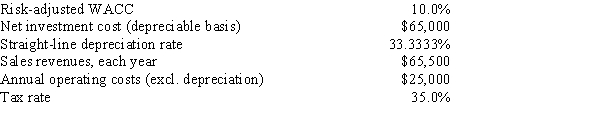

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,would be depreciated by the straight-line method over its 3-year life,and would have a zero salvage value.No change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV?

A) $15,740

B) $16,569

C) $17,441

D) $18,359

E) $19,325

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following statements is CORRECT?<br>A)

Q15: The two cardinal rules that financial analysts

Q34: Any cash flows that can be classified

Q42: Thomson Media is considering some new equipment

Q42: Which of the following statement completions is

Q43: Your company,RMU Inc.,is considering a new project

Q46: Atlas Corp.is considering two mutually exclusive projects.Both

Q51: Mulroney Corp.is considering two mutually exclusive projects.Both

Q60: Superior analytical techniques,such as NPV,used in combination

Q68: Estimating project cash flows is generally the