Multiple Choice

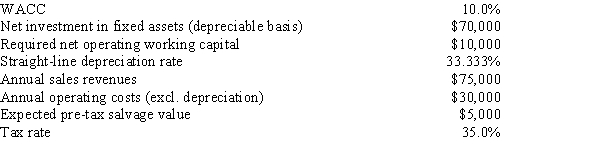

Thomson Media is considering some new equipment whose data are shown below.The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years,but it would have a positive pre-tax salvage value at the end of Year 3,when the project would be closed down.Also,additional net operating working capital would be required,but it would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV?

A) $20,762

B) $21,854

C) $23,005

D) $24,155

E) $25,363

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following statements is CORRECT?<br>A)

Q37: Your company,CSUS Inc.,is considering a new project

Q41: TexMex Food Company is considering a new

Q41: Which of the following statements is CORRECT?<br>A)

Q43: Your company,RMU Inc.,is considering a new project

Q46: Atlas Corp.is considering two mutually exclusive projects.Both

Q47: Temple Corp.is considering a new project whose

Q60: Typically, a project will have a higher

Q68: Estimating project cash flows is generally the

Q77: Which of the following statements is CORRECT?<br>A)