Multiple Choice

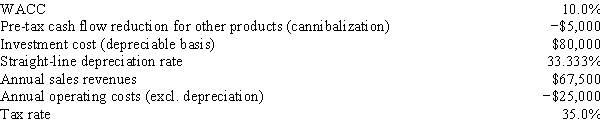

TexMex Food Company is considering a new salsa whose data are shown below.The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value,and no change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.However,this project would compete with other TexMex products and would reduce their pre-tax annual cash flows.What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $3,636

B) $3,828

C) $4,019

D) $4,220

E) $4,431

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following statements is CORRECT?<br>A)

Q37: Your company,CSUS Inc.,is considering a new project

Q41: Which of the following statements is CORRECT?<br>A)

Q42: Thomson Media is considering some new equipment

Q43: Your company,RMU Inc.,is considering a new project

Q46: Atlas Corp.is considering two mutually exclusive projects.Both

Q60: Typically, a project will have a higher

Q68: Estimating project cash flows is generally the

Q73: Which of the following rules is CORRECT

Q77: Which of the following statements is CORRECT?<br>A)