Multiple Choice

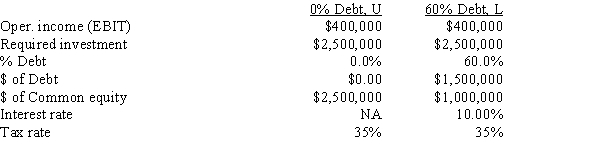

You work for the CEO of a new company that plans to manufacture and sell a new product,a watch that has an embedded TV set and a magnifying glass crystal.The issue now is how to finance the company,with only equity or with a mix of debt and equity.Expected operating income is $400,000.Other data for the firm are shown below.How much higher or lower will the firm's expected ROE be if it uses some debt rather than all equity,i.e.,what is ROEL − ROEU?

A) 5.85%

B) 6.14%

C) 6.45%

D) 6.77%

E) 7.11%

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Companies HD and LD have the same

Q23: Southwest U's campus book store sells course

Q24: Your girlfriend plans to start a new

Q25: Other things held constant, an increase in

Q34: Which of the following statements is CORRECT?

Q36: According to Modigliani and Miller (MM),in a

Q36: The graphical probability distribution of ROE for

Q65: Modigliani and Miller's second article,which assumed the

Q80: If a firm utilizes debt financing,a 10%

Q88: Which of the following statements is CORRECT,holding