Multiple Choice

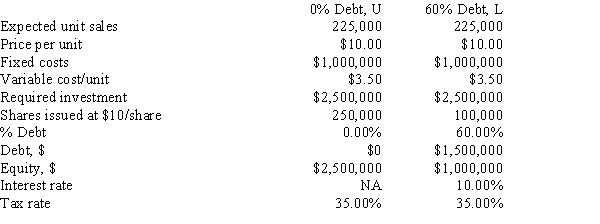

Your girlfriend plans to start a new company to make a new type of cat litter.Her father will finance the operation,but she will have to pay him back.You are helping her,and the issue now is how to finance the company,with equity only or with a mix of debt and equity.The price per unit will be $10.00 regardless of how the firm is financed.The expected fixed and variable operating costs,along with other information,are shown below.How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity,i.e.,what is EPSL − EPSU?

A) $0.54

B) $0.60

C) $0.67

D) $0.75

E) $0.83

Correct Answer:

Verified

Correct Answer:

Verified

Q21: You work for the CEO of a

Q23: Southwest U's campus book store sells course

Q27: El Capitan Foods has a capital structure

Q27: Modigliani and Miller's first article led to

Q29: Dye Industries currently uses no debt,but its

Q36: The graphical probability distribution of ROE for

Q36: According to Modigliani and Miller (MM),in a

Q65: Modigliani and Miller's second article,which assumed the

Q80: If a firm utilizes debt financing,a 10%

Q88: Which of the following statements is CORRECT,holding