Multiple Choice

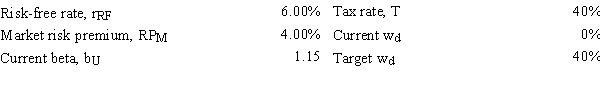

Dye Industries currently uses no debt,but its new CFO is considering changing the capital structure to 40.0% debt (wd) by issuing bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1 − wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity,i.e.,what is rL − rU?

A) 1.66%

B) 1.84%

C) 2.02%

D) 2.23%

E) 2.45%

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The Miller model begins with the Modigliani

Q16: Companies HD and LD have identical amounts

Q24: Your girlfriend plans to start a new

Q27: Modigliani and Miller's first article led to

Q27: El Capitan Foods has a capital structure

Q32: Which of the following statements is CORRECT?<br>A)The

Q34: Your company,which is financed entirely with common

Q65: Modigliani and Miller's second article,which assumed the

Q67: The Modigliani and Miller (MM)articles implicitly assumed,among

Q80: If a firm utilizes debt financing,a 10%