Multiple Choice

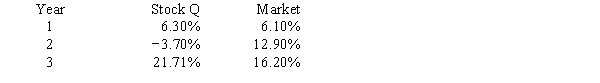

Given the following returns on Stock Q and "the market" during the last three years,what is the difference in the calculated beta coefficient of Stock Q when Year 1 and Year 2 data are used as compared to Year 2 and Year 3 data? (Hint: Think rise over run.)

A) 9.17

B) 9.63

C) 10.11

D) 10.62

E) 11.15

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Hanratty Inc.'s stock and the stock market

Q3: Stock X and the "market" have had

Q4: Exhibit 8A.1<br>You have been asked to use

Q5: Which of the following statements is CORRECT?<br>A)The

Q6: Exhibit 8A.1<br>You have been asked to use

Q7: Below are the returns for the past

Q8: Given the following returns on Stock J