Multiple Choice

On 1 July 2013 Kanga Consultants Ltd completes a contract to provide advice on the installation of a networked computer system to a company in the US.The client pays the fee of US$500 000 into Kanga Consultants' US bank account on that date.The bank pays interest of 8 per cent annually on 30 June.The exchange rate information is: What journal entries are required in Kanga Consultants Ltd's books for 1 July 2013 and 30 June 2014 in accordance with AASB 1012 (rounded to the nearest whole A$) ?

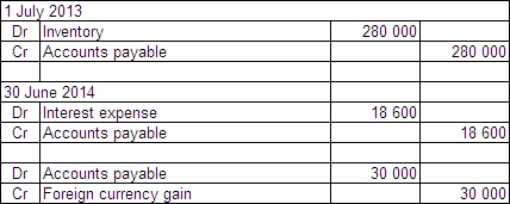

A)

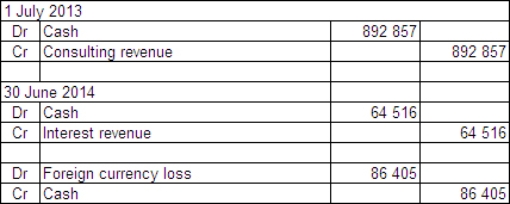

B)

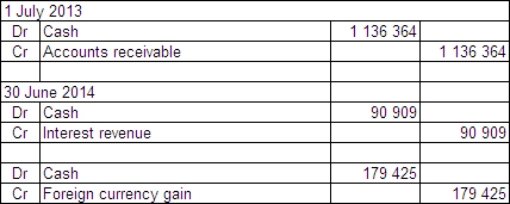

C)

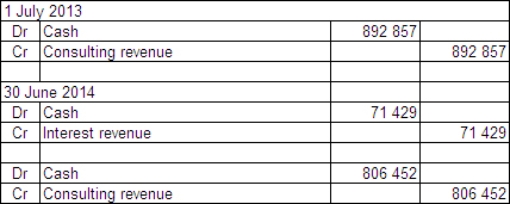

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Which of the following statements is correct

Q48: According to AASB 139,what are the five

Q49: In terms of retrospectively assessing hedge effectiveness,which

Q50: If an organisation enters a foreign currency

Q51: What is a qualifying asset,and what are

Q53: How does the accounting treatment for qualifying

Q54: Explain why some opponents of the accounting

Q55: Issues in relation to foreign currency arise

Q56: On 1 February 2014,Morinda Ltd completes

Q57: Monetary items are units of currency held