Multiple Choice

On 1 February 2014,Morinda Ltd completes a binding agreement to purchase a hydraulic lift from a manufacturer located in Germany.The cost of the equipment is €150 000.The construction of the lift is completed on 30 May 2014,and it is considered to be a qualifying asset according to AASB 123.The amount owing has not been paid by reporting date 30 June 2014.The following is information about the exchange rates: What entries are required to record the transaction and subsequent events in accordance with AASB 121 (rounded to the nearest whole A$) ?

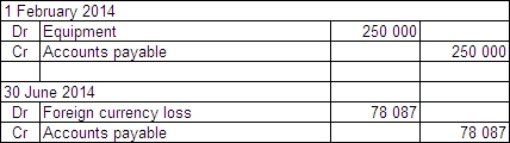

A)

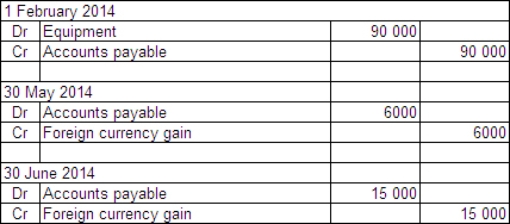

B)

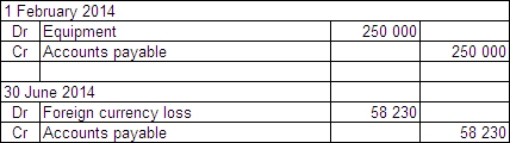

C)

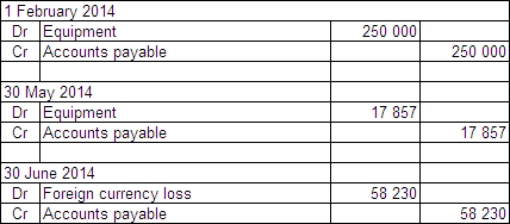

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q51: What is a qualifying asset,and what are

Q52: On 1 July 2013 Kanga Consultants

Q53: How does the accounting treatment for qualifying

Q54: Explain why some opponents of the accounting

Q55: Issues in relation to foreign currency arise

Q57: Monetary items are units of currency held

Q58: On 1 January 2014 Antique Furniture

Q59: To classify an arrangement as a hedge,and

Q60: An exception to the requirement that foreign

Q61: Emu Exports Ltd sold products to