Multiple Choice

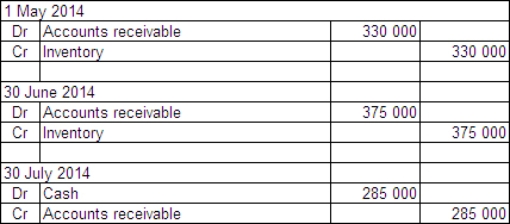

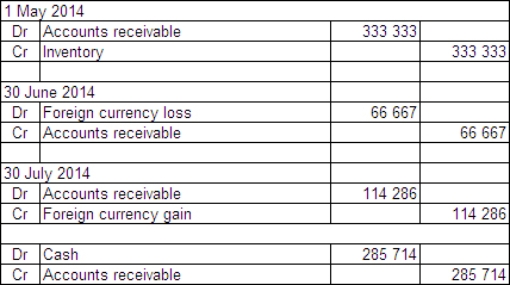

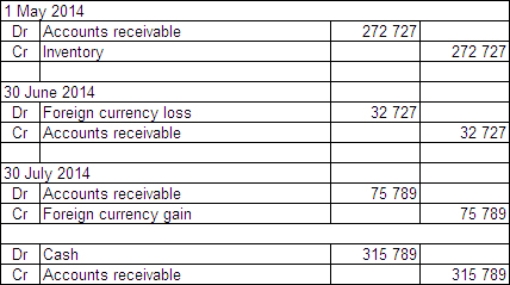

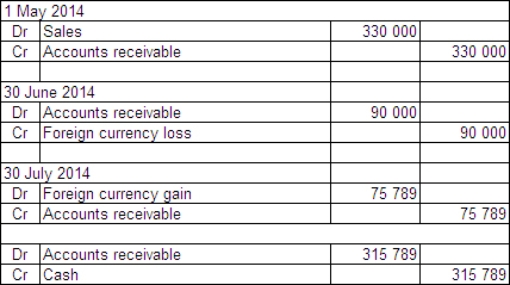

On 1 May 2014 Moorooba Exporters Ltd sells inventory to a customer in Singapore.The inventory is sold for $S300 000 and payment is not due until 30 July 2014.The reporting date for Moorooba Exporters Ltd is 30 June.The exchange rate information is: Moorooba Exporters uses a perpetual inventory system.What journal entries are required in Moorooba Exporters Ltd's books to record the transaction,adjustments at the end of the period and settlement in accordance with AASB 121 (rounded to the nearest whole A$) ?

What is the realised gain/loss on the monetary item?

A)  Realised loss $45 000

Realised loss $45 000

B)  Realised loss $66 667

Realised loss $66 667

C)  Realised gain $43 062

Realised gain $43 062

D)  Realised gain $90 000

Realised gain $90 000

Correct Answer:

Verified

Correct Answer:

Verified

Q21: On 1 May 2015 Harriet's Importers

Q22: The three principal types of hedges referred

Q23: The functional currency of an entity:<br>A) never

Q24: Which of the following items is a

Q25: An example of a foreign currency swap

Q27: AASB 121 requires that the initial recognition

Q28: The hedge effectiveness criteria prescribed in AASB

Q29: On 1 July 2015 Jarrets Ltd

Q30: The essential feature of a non-monetary item

Q31: A foreign currency transaction shall be recorded