Multiple Choice

On 1 July 2015 Jarrets Ltd borrows £500 000 from a British bank at an interest rate of 8 per cent,repayable in pounds sterling (£) and with interest due on 30 June each year.The term of the loan is 3 years.On the same date Fitners Ltd borrows A$1 million from an Australian bank at an interest rate of 10 per cent.The term of the loan is 3 years.Jarrets and Fitners decide to swap their interest and principal obligations on 1 July 2015.Exchange rate information is as follows: Both Jarrets and Fitners are Australian companies.What are the journal entries to record the swap for the period ended 30 June 2016 in Jarrets Ltd's books (rounded to the nearest whole A$) ?

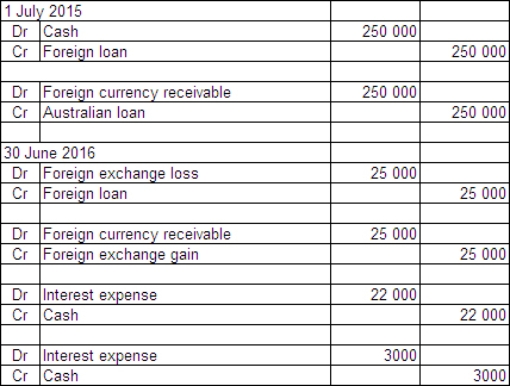

A)

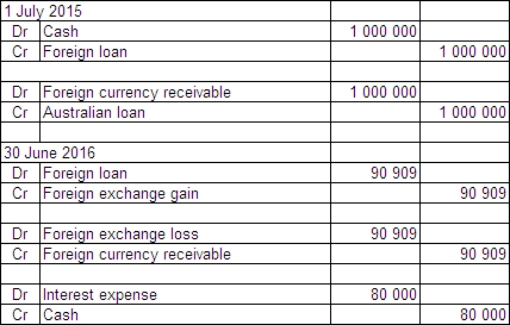

B)

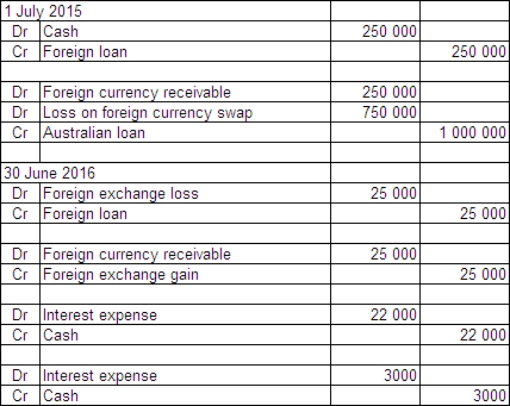

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Which of the following items is a

Q25: An example of a foreign currency swap

Q26: On 1 May 2014 Moorooba Exporters

Q27: AASB 121 requires that the initial recognition

Q28: The hedge effectiveness criteria prescribed in AASB

Q30: The essential feature of a non-monetary item

Q31: A foreign currency transaction shall be recorded

Q32: Exchange gains or losses on a qualifying

Q33: Exchange differences recognised as borrowing costs and

Q34: The purpose of 'hedge accounting' is to