Multiple Choice

Groucho Ltd purchased 60 per cent of the issued capital and in the process gained control over Marx Ltd on 1 July 2014.The fair value of the net assets of Marx Ltd at purchase was represented by:

Groucho Ltd paid cash consideration of $1 850 000 for Marx Ltd.During the period ended 30 June 2015,Marx Ltd paid management fees of $200 000 to Groucho Ltd and Marx had an operating profit of $530 000.Marx Ltd paid a dividend of $100 000 during the period.Groucho purchased inventory from Marx during the period for $80 000.The inventory cost Marx Ltd $56 000 and at the end of the period Groucho had 50 per cent of that inventory still on hand.Goodwill has been determined to have been impaired by $6200 during the period.Companies in the group use perpetual inventory systems and accrue dividends when they are declared by subsidiaries.Ignore tax implications.

For the period ended 30 June 2015,what consolidation journal entries are required and what is the non-controlling interest?

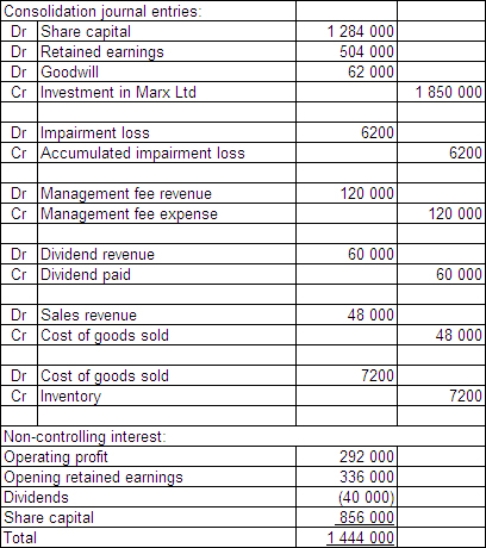

A)

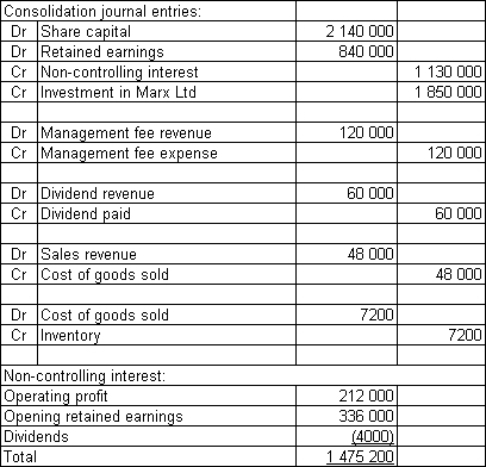

B)

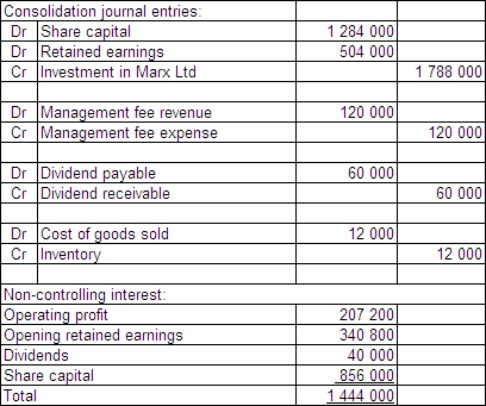

C)

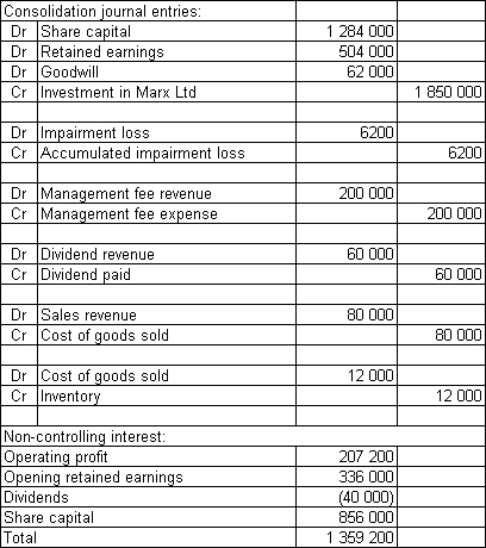

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Finger Ltd purchased 75 per cent

Q35: Discuss the three elements considered when calculating

Q36: There is no adjustment for things such

Q37: Buster Ltd owns 85 per cent of

Q38: Which of the following is not one

Q39: One of the steps in preparing consolidated

Q40: Calculating the non-controlling interest (NCI)in the operating

Q41: When a subsidiary company that has a

Q42: Which of the following statements is incorrect

Q43: Under the proprietary concept of consolidation,non-controlling interests