Multiple Choice

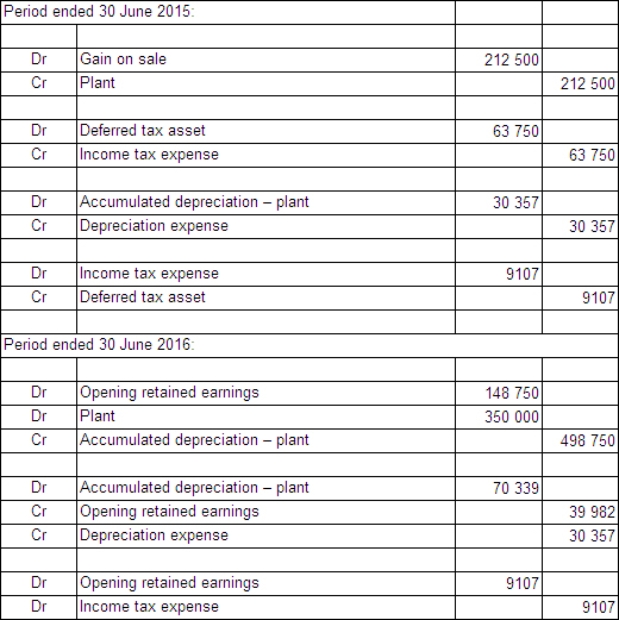

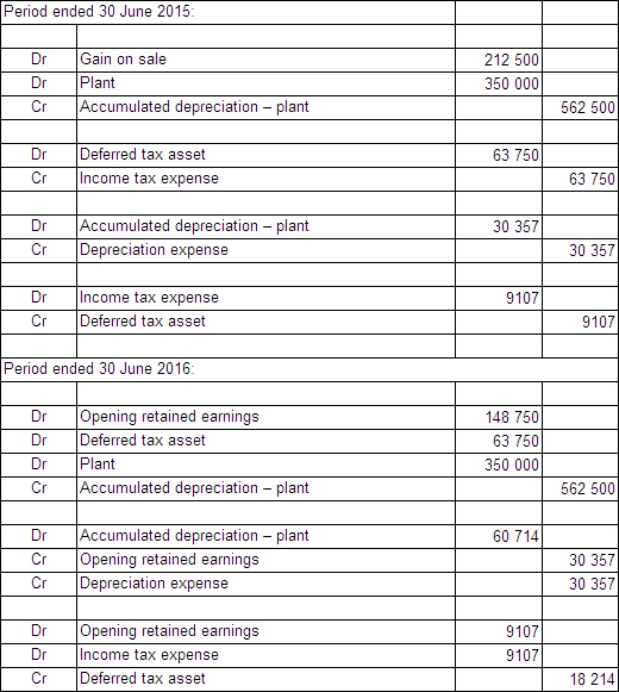

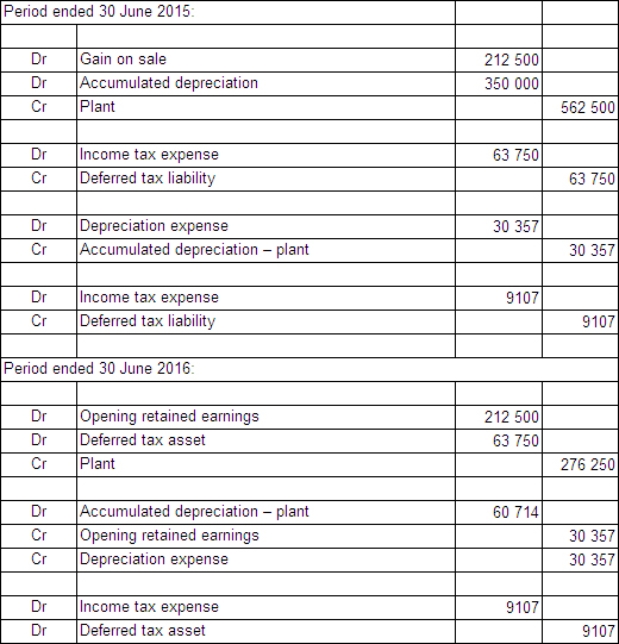

Apple Ltd owns all the issued capital of Pear Ltd.On 1 July 2014,Pear Ltd purchased an item of plant from Apple Ltd for $1 000 000.Apple Ltd had owned the plant for 5 years.It originally cost $1 350 000 and the accumulated depreciation at 1 July 2004 is $562 500.The remaining useful life of the equipment on the date of sale to Pear Ltd is estimated to be 7 years.The pattern of benefits is expected to be obtained from the equipment evenly over its useful life.The tax rate is 30%.Round all calculations to the nearest dollar. What are the consolidation journal entries required for this inter-company transaction for the periods ended 30 June 2015 and 30 June 2016?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The term 'cum div' is used when

Q11: Little Company declared a dividend of

Q12: The value of inventory on hand for

Q13: Intragroup profits are eliminated in consolidation to

Q14: Companies in an economic entity may increase

Q16: Discuss the reasoning behind the elimination all

Q17: What is the amount of unrealised profit

Q18: Zeus Ltd owns 100% of the

Q19: Belgium Ltd owns all the issued

Q20: Blue Ltd sold inventory items (with a