Multiple Choice

Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

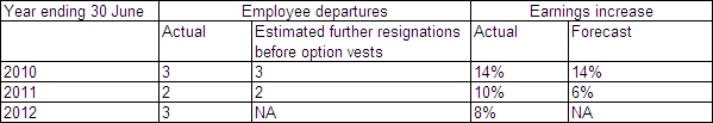

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2012?

A) $36 667

B) $44 667

C) $46 667

D) $48 000

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Penneshaw Ltd grants 100 options to

Q60: North Terraces Ltd issued share options to

Q61: Briefly describe the keys points of AASB

Q62: AASB 2 requires all share-based payment transactions

Q63: Where equity instruments are issued with a

Q65: Longreach Ltd grants 100 options to

Q66: AASB 2 requires some share-based payments to

Q67: Southport Ltd grants 100 share appreciation

Q68: AASB 2 states that when goods or

Q69: Blackburn Ltd grants 50 share options