Multiple Choice

Smith & Jones Ltd owns equipment that was purchased for $56 000 and has accumulated depreciation of $14 000.The following market value information was gathered about the equipment

The equipment has a remaining useful life to the entity of 10 years.What are the appropriate journal entries to record the revaluation under the gross method and the net-amount method?

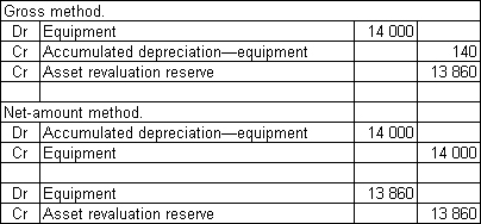

A)

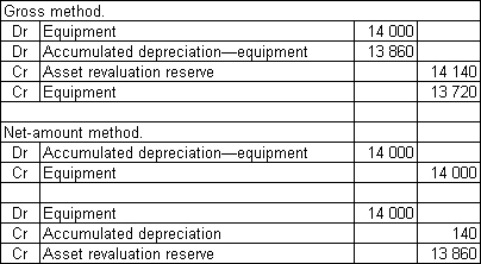

B)

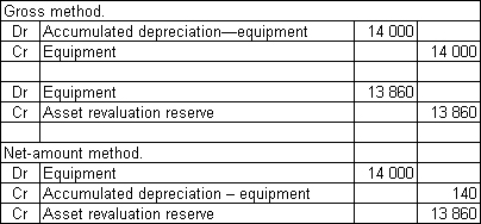

C)

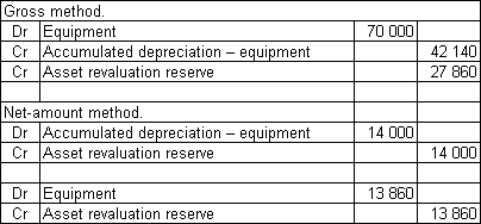

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Purple Co Ltd purchased an item of

Q40: Pigeon Ltd purchased land for $750 000

Q41: According to AASB 136 the recoverable amount

Q42: AASB 136 defines the smallest identifiable group

Q43: Mendelssons Ltd has a machine that has

Q45: Cars and Trucks Ltd owns an

Q46: Casey Co Ltd is assessing the recoverable

Q47: Differentiate depreciation expense from impairment loss.

Q48: According to Positive Accounting Theory,the size of

Q49: Discuss the process for the reversal of