Multiple Choice

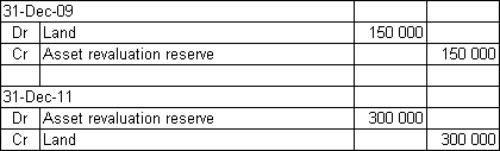

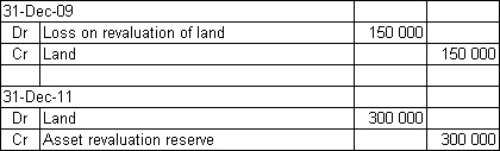

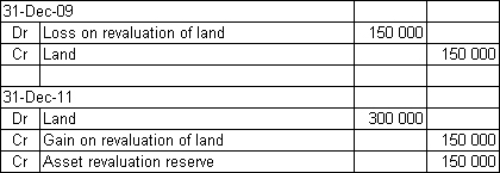

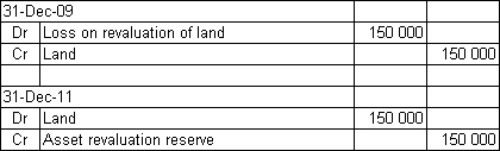

Pigeon Ltd purchased land for $750 000 6 years ago.It was revalued on 31 December 2009 to $600 000.A subsequent revaluation on 31 December 2011 found the market value to be $900 000 due to a change in council zoning for the area.What are the journal entries required to record the revaluations on 31 December 2009 and 31 December 2011?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q35: AASB 116 requires that where the replacement

Q36: A machine purchased by White Ltd

Q37: Compare the accounting treatment for investment properties

Q38: Entities that elect to report plant and

Q39: Purple Co Ltd purchased an item of

Q41: According to AASB 136 the recoverable amount

Q42: AASB 136 defines the smallest identifiable group

Q43: Mendelssons Ltd has a machine that has

Q44: Smith & Jones Ltd owns equipment

Q45: Cars and Trucks Ltd owns an