Essay

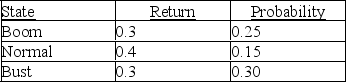

Bay Land,Inc.has the following distribution of returns:

Assuming that these returns are normally distributed,what is the probability that Bay Land,Inc.will return less than 7.25%?

Assuming that these returns are normally distributed,what is the probability that Bay Land,Inc.will return less than 7.25%?

Show all work,and clearly explain and state your answer.

Correct Answer:

Verified

Exp.Return = (.3 × .25)+ (.4 × .15)+ (.3...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: Accounting profits is the most relevant variable

Q125: The risk-free rate of interest is 4%

Q125: An investor currently holds the following portfolio:<br><img

Q126: You are going to invest all of

Q131: White Company stock has a beta of

Q133: The prices for the Electric Circuit Corporation

Q134: Emery Inc.has a beta equal to 1.8

Q142: The realized rate of return,or holding period

Q144: An investor with a required return of

Q147: Investment A has an expected return of