Multiple Choice

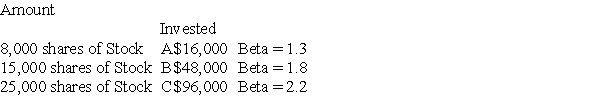

An investor currently holds the following portfolio: If the risk-free rate of return is 4% and the market risk premium is 9%,then the required return on the portfolio is

If the risk-free rate of return is 4% and the market risk premium is 9%,then the required return on the portfolio is

A) 14.00%.

B) 17.91%.

C) 21.91%.

D) 23.85%.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Accounting profits is the most relevant variable

Q92: The rate on T-bills is currently 2%.Environment

Q108: The characteristic line for any well-diversified portfolio

Q121: What is the name given to the

Q122: An investor currently holds the following portfolio:<br>Amount<br>Invested<br>8,000

Q123: Which of the following investments is clearly

Q125: The risk-free rate of interest is 4%

Q126: You are going to invest all of

Q130: Bay Land,Inc.has the following distribution of returns:<br>

Q147: Investment A has an expected return of