Multiple Choice

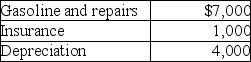

Jordan,an employee,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use.The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

A) $1,500

B) $500

C) $1,000

D) $8,000

Correct Answer:

Verified

Correct Answer:

Verified

Q69: Corporations issuing incentive stock options receive a

Q88: Gayle,a doctor with significant investments in the

Q144: Hunter retired last year and will receive

Q145: Shane,an employee,makes the following gifts,none of which

Q146: Sarah incurred employee business expenses of $5,000

Q147: Allison,who is single,incurred $4,000 for unreimbursed employee

Q148: Generally,50% of the cost of business gifts

Q150: Travel expenses related to foreign conventions are

Q151: If an employee incurs business-related entertainment expenses

Q1888: Deferred compensation refers to methods of compensating