Multiple Choice

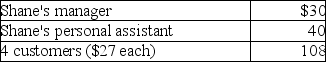

Shane,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

A) $125

B) $150

C) $75

D) $178

Correct Answer:

Verified

Correct Answer:

Verified

Q27: A qualified pension plan requires that employer-provided

Q69: Corporations issuing incentive stock options receive a

Q88: Gayle,a doctor with significant investments in the

Q144: Hunter retired last year and will receive

Q146: Sarah incurred employee business expenses of $5,000

Q147: Allison,who is single,incurred $4,000 for unreimbursed employee

Q148: Generally,50% of the cost of business gifts

Q149: Jordan,an employee,drove his auto 20,000 miles this

Q150: Travel expenses related to foreign conventions are

Q1888: Deferred compensation refers to methods of compensating