Multiple Choice

Martin Corporation granted a nonqualified stock option to employee Caroline on January 1,2013.The option price was $150,and the FMV of the Martin stock was also $150 on the grant date.The option allowed Caroline to purchase 1,000 shares of Martin stock.The option itself does not have a readily ascertainable FMV.Caroline exercised the option on August 1,2017,when the stock's FMV was $250.If Caroline sells the stock on September 5,2018,for $300 per share,she must recognize

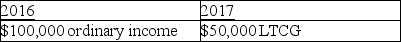

A)

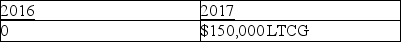

B)

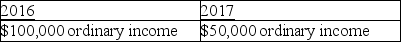

C)

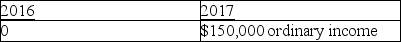

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Characteristics of profit-sharing plans include all of

Q8: Richard traveled from New Orleans to New

Q10: Steven is a representative for a textbook

Q12: The following individuals maintained offices in their

Q13: An employee has unreimbursed travel and business

Q15: Kim currently lives in Buffalo and works

Q16: Educational expenses incurred by a bookkeeper for

Q51: Which of the following statements regarding independent

Q85: A sole proprietor will not be allowed

Q602: Jack takes a $7,000 distribution from his