Essay

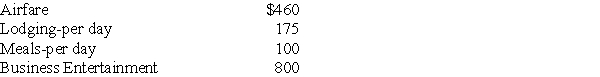

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

Correct Answer:

Verified

If personal days exceed busi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

If personal days exceed busi...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Brittany,who is an employee,drove her automobile a

Q5: Personal travel expenses are deductible as miscellaneous

Q6: Characteristics of profit-sharing plans include all of

Q10: Steven is a representative for a textbook

Q11: Martin Corporation granted a nonqualified stock option

Q12: The following individuals maintained offices in their

Q13: An employee has unreimbursed travel and business

Q85: A sole proprietor will not be allowed

Q602: Jack takes a $7,000 distribution from his

Q1643: Johanna is single and self- employed as