Multiple Choice

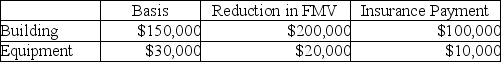

Lena owns a restaurant which was damaged by a tornado.The following assets were partially destroyed:  Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

A) $54,900

B) $60,000

C) $70,000

D) $180,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Becky,a single individual,reports the following taxable items

Q6: A taxpayer has generated a net operating

Q8: Daniel's cabin was destroyed in a massive

Q9: A flood damaged an auto owned by

Q12: A net operating loss (NOL)occurs when taxable

Q15: If a taxpayer suffers a loss attributable

Q16: A net operating loss can be carried

Q27: Vera has a key supplier for her

Q71: Which of the following is not generally

Q79: A taxpayer may deduct a loss resulting