Multiple Choice

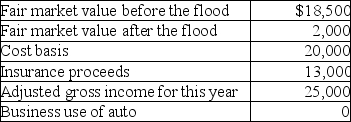

A flood damaged an auto owned by Mr.and Mrs.South on June 15 of this year.The car was only used for personal purposes.  Based on these facts,what is the amount of the South's casualty loss deduction after limitations for this year?

Based on these facts,what is the amount of the South's casualty loss deduction after limitations for this year?

A) $900

B) $1,000

C) $4,400

D) $4,500

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A taxpayer's home is destroyed by fire,resulting

Q5: Becky,a single individual,reports the following taxable items

Q6: A taxpayer has generated a net operating

Q8: Daniel's cabin was destroyed in a massive

Q10: Lena owns a restaurant which was damaged

Q12: A net operating loss (NOL)occurs when taxable

Q15: If a taxpayer suffers a loss attributable

Q16: A net operating loss can be carried

Q71: Which of the following is not generally

Q79: A taxpayer may deduct a loss resulting