Essay

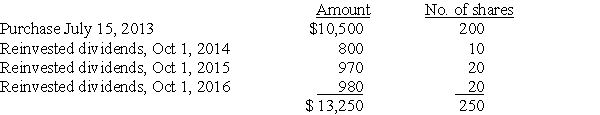

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2013,for $10,500,and has been reinvesting dividends.On December 15,2017,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Correct Answer:

Verified

Assuming FIFO,the basis in the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Maya expects to report about $2 million

Q15: The taxable portion of a gain from

Q16: In the current year,ABC Corporation had the

Q18: If a nontaxable stock dividend is received

Q38: All of the following are capital assets

Q42: Brad owns 100 shares of AAA Corporation

Q56: Will exchanges a building with a basis

Q64: Unlike an individual taxpayer,the corporate taxpayer does

Q99: In a community property state,jointly owned property

Q124: Expenditures which do not add to the