Multiple Choice

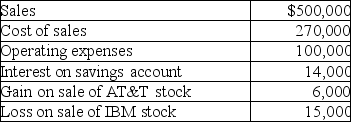

In the current year,ABC Corporation had the following items of income,expense,gains,and losses:  What is taxable income for the year?

What is taxable income for the year?

A) $135,000

B) $141,000

C) $144,000

D) $150,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: For purposes of calculating depreciation,property converted from

Q12: Maya expects to report about $2 million

Q15: The taxable portion of a gain from

Q17: Joy purchased 200 shares of HiLo Mutual

Q18: If a nontaxable stock dividend is received

Q38: All of the following are capital assets

Q56: Will exchanges a building with a basis

Q64: Unlike an individual taxpayer,the corporate taxpayer does

Q99: In a community property state,jointly owned property

Q124: Expenditures which do not add to the