Multiple Choice

Sandy and Larry each have a 50% interest in SL Partnership.The partnership and the individuals file on a calendar-year basis.In 2016,SL Partnership had a $30,000 ordinary loss.Sandy's adjusted basis in her partnership interest on January 1,2016,was $12,000.In 2017,SL Partnership had ordinary income of $20,000.Assuming there were no other adjustments to Sandy's basis in the partnership,what amount of partnership income (loss) would Sandy show on her 2016 and 2017 individual income tax returns?

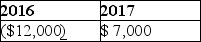

A)

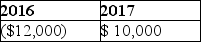

B)

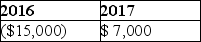

C)

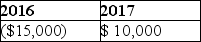

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Kuda exchanges property with a FMV of

Q47: Many professional service partnerships have adopted the

Q80: A business distributes land to one of

Q97: Raina owns 100% of Tribo Inc.,an S

Q121: Dori and Matt will be equal owners

Q136: S corporation shareholders who own more than

Q137: Which of the following is not a

Q138: Gain is recognized by an S corporation

Q140: Atiqa receives a nonliquidating distribution of land

Q143: In 2017,Phuong transferred land having a $150,000