Multiple Choice

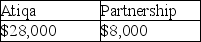

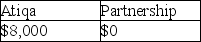

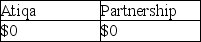

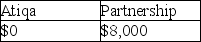

Atiqa receives a nonliquidating distribution of land from her partnership.The partnership purchased the land five years ago for $20,000.At the time of the distribution,it is worth $28,000.Prior to the distribution,Atiqa's basis in her partnership interest is $37,000.Due to the distribution Atiqa and the partnership will recognize income of

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Many professional service partnerships have adopted the

Q64: To receive S corporation treatment,a qualifying shareholder

Q80: A business distributes land to one of

Q97: Raina owns 100% of Tribo Inc.,an S

Q121: Dori and Matt will be equal owners

Q136: S corporation shareholders who own more than

Q137: Which of the following is not a

Q138: Gain is recognized by an S corporation

Q139: Sandy and Larry each have a 50%

Q143: In 2017,Phuong transferred land having a $150,000