Essay

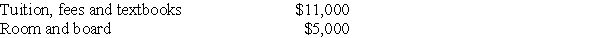

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2017:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

Tim is eligible for the American Opportu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Hawaii,Inc. ,began a child care facility for

Q5: Carlotta,Inc. ,has $50,000 foreign-source income and $150,000

Q10: Self-employed individuals are subject to the self-employment

Q13: Tanya has earnings from self-employment of $240,000,resulting

Q23: All of the following statements are true

Q41: With respect to estimated tax payments for

Q45: Yulia has some funds that she wishes

Q63: For purposes of the AMT,only the foreign

Q93: Joe,who is single with modified AGI of

Q200: Describe the differences between the American Opportunity