Essay

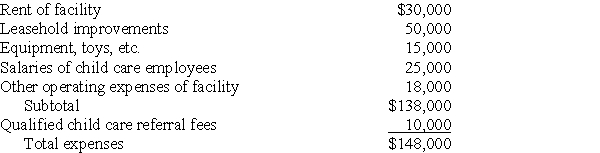

Hawaii,Inc. ,began a child care facility for its employees during the year.The corporation incurred the following expenses:

What is the amount of Hawaii's credit for employer-provided child care?

What is the amount of Hawaii's credit for employer-provided child care?

Correct Answer:

Verified

The credit is ($138,000 × .25)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: For purposes of the AMT,the standard deduction,but

Q5: Carlotta,Inc. ,has $50,000 foreign-source income and $150,000

Q8: Tom and Anita are married,file a joint

Q10: Self-employed individuals are subject to the self-employment

Q23: All of the following statements are true

Q41: With respect to estimated tax payments for

Q45: Yulia has some funds that she wishes

Q63: For purposes of the AMT,only the foreign

Q93: Joe,who is single with modified AGI of

Q107: Which of the following expenditures will qualify