Multiple Choice

Daniel recognizes $35,000 of Sec.1231 gains and $25,000 of Sec.1231 losses during the current year.The only other Sec.1231 item was a $4,000 loss three years ago.This year,Daniel must report

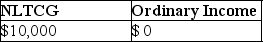

A)

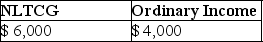

B)

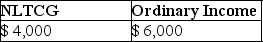

C)

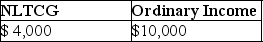

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: A corporation owns many acres of timber,which

Q15: Maura makes a gift of a van

Q32: Any gain or loss resulting from the

Q50: A taxpayer acquired new machinery costing $50,000

Q75: Lucy,a noncorporate taxpayer,experienced the following Sec.1231 gains

Q76: In 1980,Artima Corporation purchased an office building

Q76: During the current year,Danika recognizes a $30,000

Q79: The amount recaptured as ordinary income under

Q79: The following gains and losses pertain to

Q80: Brian purchased some equipment in 2017 which