Essay

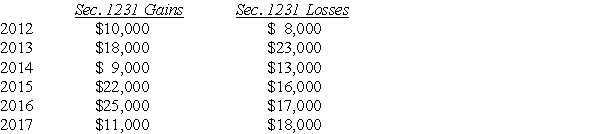

Lucy,a noncorporate taxpayer,experienced the following Sec.1231 gains and losses during the years 2012 through 2017.Her first disposition of a Sec.1231 asset occurred in 2012.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Correct Answer:

Verified

2012 $2,000 LTCG

2013 $5,000 Ordinary lo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2013 $5,000 Ordinary lo...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Maura makes a gift of a van

Q20: The additional recapture under Sec.291 is 25%

Q32: Any gain or loss resulting from the

Q35: With regard to noncorporate taxpayers,all of the

Q50: A taxpayer acquired new machinery costing $50,000

Q76: In 1980,Artima Corporation purchased an office building

Q77: Daniel recognizes $35,000 of Sec.1231 gains and

Q79: The amount recaptured as ordinary income under

Q79: The following gains and losses pertain to

Q80: Brian purchased some equipment in 2017 which