Multiple Choice

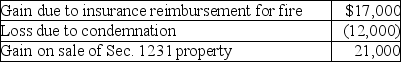

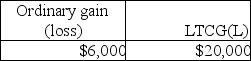

This year Pranav had the gains and losses noted below on property,plant and equipment used in his business.Each asset had been held longer than one year.  A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

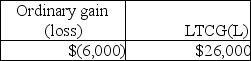

A)

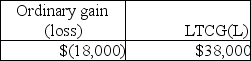

B)

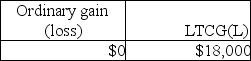

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q9: A corporation sold a warehouse during the

Q11: Alejandro purchased a building in 1985,which he

Q25: If no gain is recognized in a

Q26: Terry has sold equipment used in her

Q72: Sec.1245 can increase the amount of gain

Q81: For a business,Sec.1231 property does not include<br>A)timber,coal,or

Q84: When a donee disposes of appreciated gift

Q90: Aamir has $25,000 of net Sec.1231 gains

Q92: Gains and losses resulting from condemnations of

Q133: A business plans to sell its office