Multiple Choice

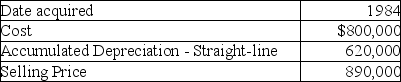

A corporation sold a warehouse during the current year.The straight-line depreciation method was used.Information about the building is presented below:  How much gain should the corporation report as Sec.1231 gain?

How much gain should the corporation report as Sec.1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: This year Pranav had the gains and

Q11: Alejandro purchased a building in 1985,which he

Q12: Cobra Inc.sold stock for a $25,000 loss

Q33: If realized gain from disposition of business

Q68: If the accumulated depreciation on business equipment

Q81: For a business,Sec.1231 property does not include<br>A)timber,coal,or

Q84: When a donee disposes of appreciated gift

Q90: Aamir has $25,000 of net Sec.1231 gains

Q92: Gains and losses resulting from condemnations of

Q133: A business plans to sell its office