Essay

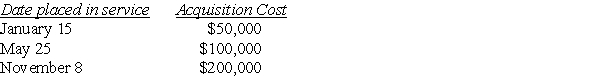

Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property in 2017 and does not use Sec.179.The property does not qualify for bonus depreciation.Mehmet places the property in service on the following schedule:

What is the total depreciation for 2016?

What is the total depreciation for 2016?

Correct Answer:

Verified

More than 40% of the assets ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

More than 40% of the assets ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Under the MACRS system,depreciation rates for real

Q14: If a company acquires goodwill in connection

Q21: Tronco Inc.placed in service a truck costing

Q38: Land,buildings,equipment,and common stock are examples of tangible

Q62: Which of the following statements regarding Sec.179

Q73: Galaxy Corporation purchases specialty software from a

Q74: On January 1 of the current year,Dentux

Q98: Everest Corp.acquires a machine (seven-year property)on January

Q99: On January 1,2017,Charlie Corporation acquires all of

Q527: Discuss the options available regarding treatment of