Multiple Choice

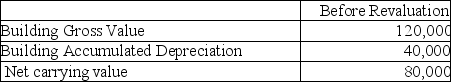

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $20,000.What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the proportional method to record the revaluation?

A) $0

B) $30,000 debit.

C) $30,000 credit.

D) $60,000 debit.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The following information is available about Fred

Q7: Speakspere Partners is scaling back operations; the

Q10: Smith Inc wishes to use the revaluation

Q21: Company One purchased land for $900,000 some

Q36: How should a revaluation entry generally not

Q60: Company Nine purchased land for $600,000 some

Q64: Which statement is not correct?<br>A)Agricultural activity involves

Q73: How is revaluation of non-current assets accounted

Q78: What is "fair value"?<br>A)The present value of

Q81: When does an entity use the "cost