Multiple Choice

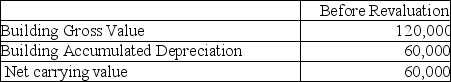

Smith Inc wishes to use the revaluation model for this property:

The fair value for the property is $150,000.Assuming this is the first year of using the revaluation model,what amount would be booked to profit and loss if Smith chooses to use the elimination method to record the revaluation?

A) $0

B) $60,000 debit.

C) $60,000 credit.

D) $90,000 credit.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following is correct with

Q7: Speakspere Partners is scaling back operations; the

Q15: Wright Now Limited (WNL)was incorporated on January

Q21: Company One purchased land for $900,000 some

Q34: How is income and expense recognized for

Q36: How should a revaluation entry generally not

Q73: How is revaluation of non-current assets accounted

Q78: What is "fair value"?<br>A)The present value of

Q81: When does an entity use the "cost

Q91: What is "fair value less costs to