Essay

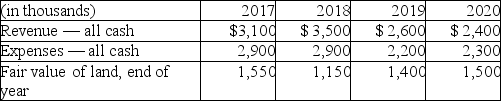

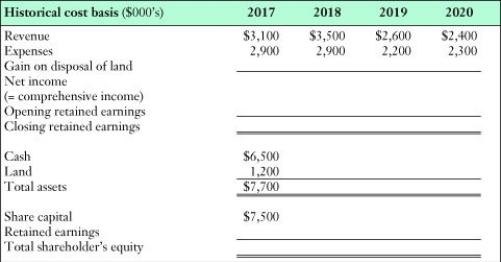

Wright Now Limited (WNL)was incorporated on January 1,2017 when the sole shareholder invested $7,500,000.This is the only financing the firm needed.WNL used $1,200,000 of the funds to purchase land.WNL developed a single project from 2017-2020.Pertinent financial details of this project are set out below.At the end of 2020 the land was sold for its fair value.

Required:

Complete the following table,assuming that WNL uses the historical cost basis of measurement.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following is correct with

Q10: Smith Inc wishes to use the revaluation

Q18: Explain the meaning of biological assets and

Q20: How is "discontinued operations" information presented in

Q21: Company One purchased land for $900,000 some

Q34: How is income and expense recognized for

Q42: How is a revaluation loss on non-current

Q49: Which of the following is correct with

Q69: Explain how non-current assets that are held

Q91: What is "fair value less costs to