Multiple Choice

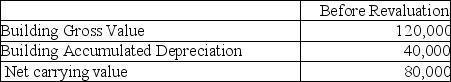

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.Assuming this is the first year of using the revaluation model,which of the following amounts will be booked?

A) $60,000 debit to profit and loss.

B) $60,000 credit to profit and loss.

C) $60,000 debit to OCI.

D) $60,000 credit to OCI.

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Smith Inc wishes to use the revaluation

Q61: Due to increased competition from low-cost foreign

Q62: Wilson Inc wishes to use the revaluation

Q64: Wallace Inc wishes to use the revaluation

Q66: What is the recoverable amount for this

Q68: Smith Inc wishes to use the revaluation

Q70: Based on the following information,what is the

Q77: Explain the accounting for assets related to

Q94: What is "value in use"?<br>A)The present value

Q107: When does agricultural activity end?<br>A)At the acquisition