Multiple Choice

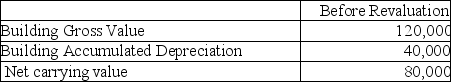

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

A) $16,000 debit.

B) $16,000 credit.

C) $28,000 credit.

D) $28,000 debit.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: Based on the following information,what is the

Q59: Based on the following information,what is the

Q60: Smith Inc wishes to use the revaluation

Q61: Due to increased competition from low-cost foreign

Q64: Wallace Inc wishes to use the revaluation

Q65: Wilson Inc wishes to use the revaluation

Q66: What is the recoverable amount for this

Q77: Explain the accounting for assets related to

Q103: Which of the following is correct with

Q107: When does agricultural activity end?<br>A)At the acquisition